Liquidity Pools

Contrary to the inefficient Peer-To-Peer model, the Unlockd liquidity model relies on Liquidity Pools.

Users contribute their assets to a large pool of liquidity called the Lending Pool. This pool is available for borrowers to borrow from, and lenders share in the interest that borrowers pay back to the pool.

Benefits of Liquidity Pools

The primary advantage of utilizing Liquidity Pools is the immediate availability of funds for borrowers. Unlike traditional Peer-to-Peer lending, which requires matching individual lenders with borrowers, Liquidity Pools allow for instant borrowing without the wait, streamlining the loan process significantly.

uTokens

One of the advanced features of the lending pool contract is the tokenization of the lending position.

When users deposit assets, they receive a corresponding amount of uTokens (uUSDC for the stablecoins pool). All interest collected by the Borrowing Interest Rates model is distributed to uToken holders directly by continuously increasing their wallet balance.

uTokens are the interest-bearing ERC-20 tokens that map the liquidity deposited and accrue interest based on the underlying deposited asset (USDC), with a 1:1 ratio.

uTokens are minted upon deposit. Their value increases until they are burned on redemption (withdrawing the liquidity from the Lending Pool).

uTokens can be safely stored, transferred, or traded, and redeemed for their underlying assets at any time.

Deposit APY

uTokens holders receive continuous earnings that evolve with market conditions.

uTokens holders share the interests paid by borrowers. The borrow interest rates paid are distributed as yield for uTokens holders who have deposited in the protocol, excluding a share of yields sent to the ecosystem reserve defined by the reserve factor. This interest rate is paid on the capital lent out and then shared among all the liquidity providers.

The deposit APY, Dt, is:

Dt=Ut∗Bt∗(1−Rt).

Ut: the utilisation ratio.

Bt: the variable borrow rate.

Rt: the reserve factor.

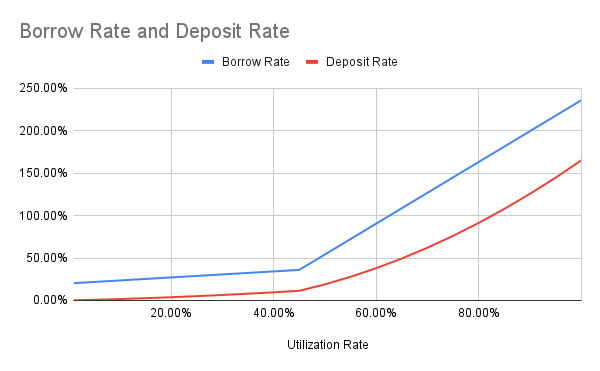

Deposit Interest Rate Curve

You can view the protocol's real-time deposit APY on the Unlockd dApp for providing liquidity in the form of USDC tokens.

For learning about the Borrower Interest Rates model, check our Risk Framework Documentation.

Last updated