Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

The next sections of the documentation teach you how to use every feature and functionality of Unlockd V2.

Please, refer to our step-by-step guide to Repaying partially or totally your Loan.

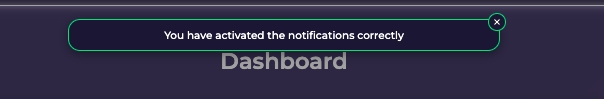

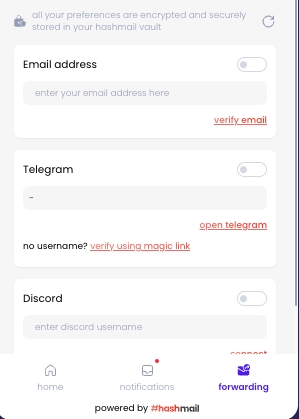

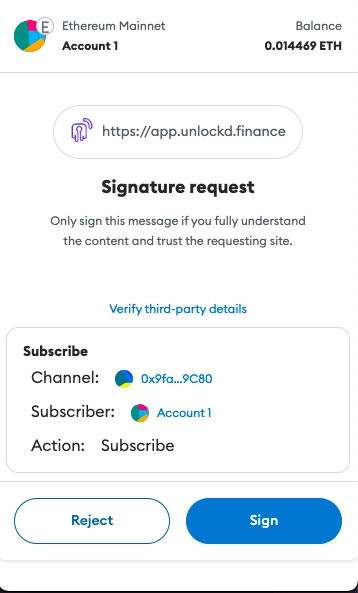

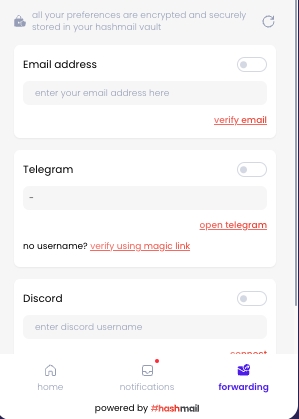

Please, refer to our step-by-step guide to Understanding Unlockd Notifications.

Coming soon...

Real Estate

(Pending integration) VESTN (Pending integration)

Watches

Despite being issued by one of our supported partners, some assets may temporarily not be available for loans. This is primarily due to challenges in obtaining reliable appraisal data for these specific assets. We are actively working towards resolving these data issues to ensure broader asset support in the near future.

Unlike peer-to-peer loans marketplaces, Unlockd operates with a much more efficient system of pooled liquidity.

Unlockd's liquidity pools are smart contracts responsible for locking tokens, USDC for instance, to ensure the liquidity of those tokens to be borrowed by users when they take out a loan.

Liquidity PoolsUnlockd stands apart from conventional lending platforms with its liquidity pools. These smart contracts, specifically for USDC, lock in assets to ensure consistent liquidity for borrower loans. This model enhances efficiency, offering a dynamic lending and borrowing environment.

As a lender on Unlockd, your contributions provide vital liquidity, enabling efficient lending processes and earning potential, all within a framework of robust risk mitigation.

As a lender, you can deposit your assets into these pools and in return, receive uTokens, representing your share in the pool. This process offers flexibility:

No Deposit Limits: You can deposit any amount, with no minimum or maximum limits.

Transaction Cost Consideration: For smaller amounts, it’s important to consider that the transaction cost might outweigh the expected earnings. This is crucial for optimizing your investment strategy.

Dynamic APY: The yield on uTokens varies with market conditions. Each asset has its own supply and demand dynamics, influencing its Annual Percentage Yield (APY).

Unlockd's lending pools are designed to maximize your earnings and optimize the taxation derived from your profits by providing liquidity. When you deposit your assets and receive yield, it is automatically reinvested in the pool to compound and grow your return exponentially.

Unlockd's auto-compounding feature offers tax efficiency for lenders. Your earnings are reinvested automatically, delaying capital gains taxes until you withdraw, making Unlockd an effective choice for tax-smart yield generation.

uToken Redemption: Withdraw your liquidity by returning the uTokens received during your deposit. These tokens are burned, and your assets are returned.

Liquidity Availability: Withdrawals depend on the available liquidity in the pool. If the pool’s resources are tied up in loans, you may need to wait for liquidity to free up from either additional lender contributions or borrower repayments.

The primary risk for lenders is the potential default of borrowers and market volatility affecting the value of liquidated collateral. Unlockd mitigates these risks through:

Multi-Asset Collateral: This feature allows borrowers to use multiple RWAs as collateral, diversifying risk.

Diluted Impact: The pooled liquidity model spreads risk across numerous participants, reducing the impact of individual defaults.

Dynamic LTV Models: These models are designed to minimize the occurrence of loss, except in extreme market conditions.

Unlockd is the only permissionless RWA liquidity protocol powered by advanced AI where users can participate as depositors or borrowers.

It facilitates the safest, most secure, and cost-effective way to borrow against tokenized Real-World Assets and financial assets with instant loans, as well as risk-free, auto-compounding yield directly in USDC for lenders.

It is, at its core, a set of smart contracts deployed to the Ethereum Mainnet (and soon to multiple L2s), where LPs (lenders) deposit their assets in pools to receive yield in exchange for their liquidity contribution.

This is a Peer-To-Pool model, more efficient and fair than other Peer-To-Peer models. Borrowers take permissionless loans with no fixed expiration date, instantaneously, with a fair interest rate, and against their tokenized assets — if they are supported.

Our advanced AI ensures the best loan conditions (asset valuation and smart Loan-To-Value), tailored to your needs, without the complexity.

As a liquidator on Unlockd, you play a vital role in upholding the stability and integrity of the lending ecosystem.

When a borrower's collateral value dips below the minimum threshold, triggering liquidation, your job is to strategically participate in the process to acquire discounted assets while also ensuring lenders are protected.

Before diving into borrowing or engaging in any debt-related activities on Unlockd, establishing your Unlockd Account is essential. This account is your hub for depositing RWAs, creating and managing loans, and monitoring your digital assets. Here's how to get started:

Continuous Earnings: Your earnings are a share of the interest accrued by borrowers when they repay their loans. Future plans may include additional earnings through UNLK token rewards.

Efficient Yield Generation: Lenders contribute liquidity to pools, receiving yields in return. This Peer-to-Pool system is more efficient than traditional Peer-to-Peer models.

Accessible Platform: Unlockd's permissionless nature eliminates complex verification, welcoming a broad user base.

Rapid Loan Processing: Borrowers receive instant loans against eligible RWAs, with plans for future cross-chain functionality.

Fair Interest Rates: The platform ensures reasonable rates, without fixed loan expiration dates.

Accurate RWA Valuation: Partnering with leading appraisal firms, Unlockd uses AI and machine learning for individual asset assessments, avoiding reliance on floor prices.

Adaptive LTV Rates: Dynamic LTV adjustments are made in response to real-time market data, benefiting both borrowers and lenders.

True Custody Feature: Borrowers maintain full custody and ownership rights of their collateralized assets through their Unlockd Account. This ensures that users remain the custodians of their assets, with Unlockd only intervening to prevent unauthorized transactions during active collateral periods.

Compliance and KYC Adherence: By retaining custody of their assets through their Unlockd Account, users ensure compliance with KYC regulations and other requirements from asset issuers. This setup makes ownership and accountability transparent and verifiable, facilitating regulatory adherence and proof of ownership and reducing risks.

Proven Security Standards: Audited by multiple auditing firms, Unlockd's protocol avoids common vulnerabilities of other lending platforms.

Comprehensive Risk Framework: A specialized framework evaluates asset and liquidity risks, providing tailored LTV for individual assets.

Multi-Asset Collateral: Unique bundling of various assets into one loan enhances borrowing capacity and diversifies risk.

Unlockd Marketplace: Offers flexibility in asset transactions, allowing listings across all aggregated marketplaces, instant selling and auctions with attached debt.

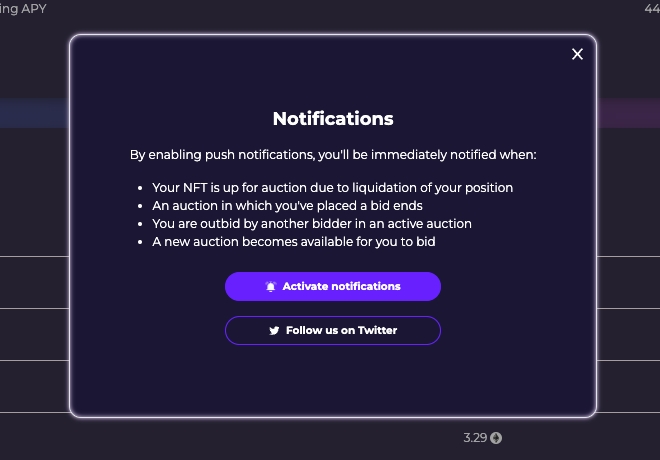

Customizable Notifications: Integration with hashmail enables users to stay informed about their investments and protocol updates.

Community-Driven Governance: Transitioning towards decentralized governance, Unlockd is supported by a robust community and prominent investors.

Planned Developments: Introduction of transaction fees to benefit token holders and expand the DAO treasury, along with ongoing decentralization efforts.

Unlockd doesn't charge protocol fees.

Coming soon...

Stocks

Coming soon...

Collectibles

Gems & Precious Metals

Tiamonds (Pending integration) Mattereum (Pending integration)

Fine Wine

GrtWines (Pending integration)

Private Funds

Coming soon...

Private Equity

Coming soon...

Senior Credit

Coming soon...

Treasuries Bills

Coming soon...

Secondaries

Coming soon...

Venture Capital

Check Loan List: Regularly monitor the list of active loans sorted by health factor. Focus on those nearing or below the critical 1.0 threshold, as they present liquidation opportunities.

Custom Alerts: Set up notifications for specific loan health factor milestones. When a loan you're tracking falls below a particular level, you'll get an alert so you can take swift action.

Analyze Collateral: Scrutinize the collateral assets of at-risk loans. Estimate their value based on current market conditions and intrinsic traits like rarity. This allows you to strategize your bids effectively during liquidation.

Timing: Closely follow market trends, major events, and protocol changes that could impact asset values. Liquidity events often present increased liquidation opportunities.

Major market volatility can decrease collateral values, so liquidations carry inherent risks. Moderate position sizes accordingly.

Bid Strategizing: Determine your auction bids based on current collateral valuations and the starting bid, which is either the appraisal or the Critical Recovery Threshold (CRT).

Bid Now, Pay Later: Utilize this feature to bid on collateral RWAs without fully paying upfront. The RWAs become collateral for a new loan issued by Unlockd.

Binding Bids: Understand that your bids are binding on-chain transactions, ensuring auction integrity. The bid amount goes directly to debt reduction.

Monitor Auction Dynamics: Follow the auction closely as it progresses. Higher bids repay earlier bidders and further reduce outstanding debt.

Incentive Rewards: If your bid gets outbid, you receive a 2.5% reward on the bid amount for initiating the auction.

Claiming assets: After winning an auction, manually claim the assets. This transfers ownership to you.

Timing Liquidations: Consider market conditions and optimal timing when liquidating acquired assets to maximize profits.

Capitalize on Discounts: If you can sell liquidated assets above the purchase price, you profit from the discount acquired at auction.

Accept ToS: You'll first need to accept the Terms of Service (ToS) and sign them digitally. This step is crucial and ensures you're informed about the platform's policies.

Confirm Account Creation: Finalize your account setup by confirming a blockchain transaction. This action requires a small gas fee.

The health factor is the numeric representation of the safety of your deposited assets against the borrowed cryptocurrency and its underlying value. The higher the value is, the safer the state of your funds are against a liquidation scenario.

For each wallet, the LTV and Liquidation threshold risks parameters enable the calculation of the health factor:

When the position may be liquidated to maintain solvency.

Depending on the value fluctuation of your deposits, the health factor will increase or decrease. If your health factor increases, it will improve your borrow position by making the liquidation threshold more unlikely to be reached. In the case that the value of your collateralized assets against the borrowed assets decreases instead, the health factor is also reduced, causing the risk of liquidation to increase.

0.0 < HF < 1.0: Dangerous, borrower may lose collateral if the debt is not repaid as soon as possible.

1.0 <= HF <= 1.5: Risky, borrower should repay part of the debt timely.

1.5 < HF < 2.0: Careful, borrower should pay attention and monitor their debt.

Liquidation will be triggered if the HF reaches 1.

The Loan to Value (LTV) ratio defines the maximum amount of currency that can be borrowed with a specific collateral. It’s expressed as a percentage: at LTV=30%, for every $100 worth of asset collateral, borrowers will be able to borrow $30 worth of USDC.

With the latest update to our underlying model, users can now avail themselves of loans amounting to up to 75% of the actual value of their assets. This enhancement is coupled with our steadfast commitment to upholding the highest standards of financial security, positioning us as a leading RWA-backed protocol in terms of advanced safety measures.

Unlockd's Data Science team has developed a sophisticated Dynamic Loan-To-Value (LTV) model, expertly balancing user risk in an optimal way.

The LTV model considers a range of factors, such as the volume of data available for asset valuation and the current market volatility. High-quality, abundant data coupled with low volatility leads to a higher LTV, reflecting the enhanced reliability of the valuation algorithm in stable market conditions.

The model is designed to adjust LTVs in real-time, responding to changes in overall market volatility, specific asset class volatility, and the volatility of individual assets.

Proactive Safeguards: Beyond setting loan collateral ratios, the dynamic LTV model plays a crucial role in risk mitigation. It closely monitors reserve levels and the activities of other lending protocols to inform its decisions. An increase in reserves triggers a strategic response from the model, reducing the issuance of new category-based loans, thereby managing selling pressure on the protocol.

Maintaining Stability: This proactive management of lending activities, based on reserve levels and market dynamics, is vital in sustaining the protocol's integrity and resilience. It effectively shields the protocol from potential adverse effects of market fluctuations, securing its long-term health and reliability.

You can learn about all the aspects of this model here:

Receive an $UNLK airdrop covering the total cost of all your mints. If you're already entitled to a larger airdrop, a multiplier will be applied.

Early access to the Unlockd mainnet and all future features. Be the first to test pioneering and unique NFT x DeFi strategies.

Receive extra token rewards and incentives for testing the protocol early features, higher than users who do not hold any Lockey.

Private community events in Discord and our Metaverse space. Limited alpha, gaming, education, entertainment and more!

Until the official token is released, all holders will be able to vote on Unlockd decisions. You decide the future of The Lockeys.

Being a Lockey holder will make you eligible for possible future promotions, limited incentive programs and fee discounts.

The Lockeys universe will continue to expand, full of surprises and unique opportunities for holders. Stay tuned!

Unlockd has raised a US$4.4M seed round + US$1M bridge round to unlock the full liquidity and utility of the digital asset economy.

Despite having increased both the capital to be raised and the valuation, we are proud to say that Unlockd received offers oversubscribing for more than 3x.

This funding comes from some of the most reputable firms and angel investors in the industry:

Blockchain Capital (LEAD)

Sfermion

When liquidity is deposited into Unlockd pools, it serves as the source of funds for borrowers accessing loans.

However, there are instances when the utilization rate is low, resulting in idle liquidity within the pools.

To maximize the potential of this idle liquidity, Unlockd has introduced the Idle Liquidity Booster. Through this program, the idle liquidity is routed towards the most secure and trusted protocols in the DeFi landscape, engaging in ultra-low-risk farming strategies via the AI-powered maxAPY protocol.

The additional yield generated from these strategies is mainly utilized to boost the yield accrued by lenders when the utilization rate is low. This ensures that lenders benefit from increased returns on their deposited funds .

Additionally, this extra yield will also be directed towards reducing the interest paid by borrowers, providing them with a cost-saving advantage when repaying their loans, when the utilization rate grows.

The next move in permissionless RWA liquidity.

Unlockd's innovative approach to RWA-backed lending focuses on four key areas that set up apart:

Take loans instantly with the only permissionless protocol in RWA Finance.

Enjoy AI for real-time asset appraisal and mathematically optimal loan rates.

Bundle up to 100 RWAs in the same loan for diversified risk and enhanced borrowing power.

Unlockd ensures that users retain full ownership and custody of their collateralized assets through user-specific wallets (Unlockd Accounts). While Unlockd has signing rights to these wallets to prevent unauthorized transactions when assets are used as collateral, the custodial responsibility remains with the user.

User Ownership and Custody: Users maintain full ownership and custody of their assets. Unlockd does not take custody of the assets but ensures their security by preventing unauthorized transfers during active collateral periods.

Preventing Unauthorized Transfers: Unlockd’s signing rights are used exclusively to prevent unauthorized transactions when assets are active collateral. This ensures that the assets remain secure and cannot be transferred without proper authorization.

In Unlockd's commitment to a fair and supportive borrowing environment, the Borrower Grace Period plays a vital role. This period is a key protective measure, offering borrowers a significant window to address and rectify potential liquidation scenarios, with the duration varying based on the type of collateralized asset.

The Borrower Grace Period is initiated the moment a loan's liquidation is triggered.

Its primary purpose is to provide borrowers with a fair chance to respond and take necessary actions to protect their collateralized assets. During this critical timeframe, the auction for the collateralized assets opens, but borrowers retain the power to avert the loss of their assets.

Unlockd's Marketplace enhances the RWA acquisition experience with its "Bid-Now-Pay-Later" feature, a unique blend of bidding and instant loan creation.

This feature simplifies the process of acquiring assets by instantly leveraging them as collateral for a new loan.

Contrary to the inefficient Peer-To-Peer model, the Unlockd liquidity model relies on Liquidity Pools.

Users contribute their assets to a large pool of liquidity called the Lending Pool. This pool is available for borrowers to borrow from, and lenders share in the interest that borrowers pay back to the pool.

The primary advantage of utilizing Liquidity Pools is the immediate availability of funds for borrowers. Unlike traditional Peer-to-Peer lending, which requires matching individual lenders with borrowers, Liquidity Pools allow for instant borrowing without the wait, streamlining the loan process significantly.

2.0 <= HF: Safe, the loan is at no close risk of liquidation.

Spartan Group

Play Ventures

IDEO CoLab

Bitscale

Sanctor Capital

Emoote

Jets Capital

Eden Ventures

Caballeros Capital

Emfarsis

Crypto Plaza

YGG (Yield Guild Games)

YGG SEA

BREEDER DAO

Blockchain Space

Gabby Dizon (YGG Founder)

Colin Goltra (YGG COO and NFT collector)

Peter Ing (BlockchainSpace Founder)

Renz Chong (BreederDAO Co-Founder)

There is interest in our product, and we are turning our vision into a working protocol backed by many of the best investors in the industry.

“Unlockd is the missing piece on-chain debt markets need to evolve to their optimal state with a size equivalent to traditional finance. Enabling the use of Real-World Assets, both physical and financial, as collateral is an industry game-changer that will bring to DeFi both institutional and mainstream retail investment.”

— Jorge Schnura, Unlockd Co-Founder

Blockchain Capital (LEAD)

Blockchain Capital is a leading venture firm in the blockchain industry. In the last 8 years, they have made over 125 investments in companies and protocols in the sector, across different stages, geographies and asset types.

Blockchain Capital leads this seed round of Unlockd.

Sfermion

Founded in 2019, Sfermion is an investment firm focused on the metaverse. Their goal is to accelerate the emergence of the metaverse by investing in the founders, companies, and protocols creating the infrastructure and environments that will form the foundations of our digital future.

Spartan Group

Spartan Capital is a digital asset management firm that takes a fundamental approach to identifying unique investment opportunities in the emergent crypto asset class. Their investment team has over 20 years of experience in investment research and capital management for top-tier firms such as Goldman Sachs and Indus Capital.

Play Ventures

Play Ventures is the leading early-stage VC fund investing in gaming and gaming services startups around the world. The fund was founded in 2018 by former gaming entrepreneurs Henric Suuronen and Harri Manninen.

IDEO CoLab

IDEO CoLab Ventures invests in early-stage distributed web startups and co-creates with them to ship new products and protocols. CoLab works across industries at the intersection of emerging tech, societal systems, and human needs.

Bitscale

Bitscale invests in teams and solutions that bring transparency and efficiency to our world with cutting-edge technologies. They also help with investors relations, community building — by increasing awareness and brand exposure in Russia/CIS as well as in Asia — and post-launch support and advisory.

Sanctor Capital

Sanctor Capital is a thesis-driven investment fund and deploys capital across both primary and secondary markets. As founders and crypto natives themselves, they understand the challenges faced by early-stage projects and provide active investor-side support through mentorship and network integration.

Emoote

Emoote is a venture capital firm dedicated to fostering innovation and growth in the Web3 and digital entertainment sectors. Led by a team of seasoned professionals, Emoote brings a wealth of experience from various industries, including digital entertainment, blockchain technology, and venture investing.

Jets Capital

Jets.Capital supports crypto and Web3 startups at initial stages. Their mission is to help modern technologies to smoothly enter our lives and change the world for the better. They provide a holistic ecosystem for startups to grow and have partners to take care of all aspects - be it advertising, legal, promotion, listings, go-to-market expertise and more.

Ed3n Ventures

Ed3n Ventures is a leading web3 venture studio, dedicated to building projects that enable the open metaverse. They work with founders to provide expertise, funding, and access to Eden’s strategic network of advisors and partners. Aside from their web 3.0 ventures, Ed3n has also been actively building and growing a portfolio of e-commerce and tech startups in Southeast Asia over the past decade.

Caballeros Capital

Caballeros Capital is a private investment firm focused on investing in the blockchain innovation space.

Emfarsis

Emfarsis is an advisory and investment firm based in Asia Pacific focused on crypto, NFTs, open Metaverse and Web3 innovation for social impact. Whether it is international expansion or moving into the metaverse, they splice economic data with real-life human stories to help identify the market opportunity.

Crypto Plaza

Crypto Plaza is the largest crypto economy hub in Southern Europe. Based in Spain, it is a community of the leading companies, startups and investors in the sector. They are a worldwide reference in the Crypto Assets and Blockchain space, and lead the Spanish-speaking and Southern European market.

YGG (Yield Guild Games)

YGG is the world’s leading Play-To-Earn guild that brings players together to earn via NFT games. They are the settlers of the Metaverse and invest in GameFi-related projects.

YGG SEA

YGG SEA is the first subDAO of Yield Guild Games, with the mission of creating the biggest and most sustainable play-to-earn virtual economy in Southeast Asia.

BreederDAO

BreederDAO is the NFT asset factory of blockchain games. They provide high-volume asset production, tailored to specification, for some of the largest guilds in the Metaverse so they can supercharge their play-to-earn economies.

BlockchainSpace

BlockchainSpace is a guild hub for play-to-earn communities, with end to end solutions including CRM, Guild Data Analytics and Guild Financial Bank.

Notable angel investors

Gabby Dizon (YGG Founder)

Colin Goltra (YGG COO and NFT collector)

Peter Ing (BlockchainSpace Founder)

Renz Chong (BreederDAO Co-Founder)

Keep enjoying all the compliance adherence, custody and utility associated with owning your assets while deposited.

Unlockd revolutionizes the RWA lending market by prioritizing accessibility and simplicity, being the first permissionless protocol that allows instantly borrowing against real estate, luxury watches, collectibles, precious metals, gemstones, fine wine and financial assets.

Ease of Access: Our platform eliminates complex verification processes, making it accessible to everyone and fostering a truly inclusive financial environment.

Simplified User Experience: We have designed our interface to be intuitive, allowing users to easily navigate our lending options without unnecessary complications.

Instant Loan Execution: Understanding the dynamic nature of the crypto market, Unlockd ensures immediate loan transactions. Once terms are accepted by the borrower, funds are quickly disbursed, empowering users to seize market opportunities promptly.

At Unlockd, we integrate cutting-edge AI technology to redefine asset appraisal and risk assessment in RWA-backed lending:

Advanced Collateral Appraisal: The key to our precise collateral valuation lies in our data providers' use of sophisticated machine learning algorithms. Unlike traditional methods that rely on floor prices, our approach assesses each asset individually, determining its true value based on a comprehensive analysis of market data and trends. This method ensures a more accurate, fair, and reliable appraisal of each asset.

Dynamic LTV Determination: Our AI-driven system constantly analyzes data of liquidity, volatility and market depth, offering realistic and advantageous Loan-To-Value rates, benefiting both borrowers and lenders.

Adaptive Risk Modeling: Our algorithms are tailored to adapt to market fluctuations in real-time, ensuring a balanced and secure lending platform by adjusting LTV rates in response to market trends.

Unlockd introduces the ability to bundle multiple RWAs from various collections or types into a single loan. This unique approach offers several advantages:

Enhanced Borrowing Power: By bundling diverse assets into one loan, borrowers can leverage a broader range of assets, increasing the overall loan value they can access.

Risk Diversification: This bundling allows for a more balanced risk profile. By not relying on a single asset or asset type, borrowers can mitigate the impact of market fluctuations on individual assets.

Simplified Management and Gas Efficiency: Managing one bundled loan instead of multiple individual loans streamlines the borrowing process, making it more user-friendly and extremely gas-efficient.

Unlockd ensures that borrowers retain full custody and ownership of their collateralized assets through our innovative Unlockd Account technology. This feature allows users to remain the custodians of their assets, with Unlockd only intervening to prevent unauthorized transactions during active collateral periods.

Custody Preservation: Unlike traditional lending platforms, which require you to forfeit control over your assets, Unlockd allows borrowers to maintain full custody. This means that while your assets are collateralized, you retain complete control and ownership, ensuring security and regulatory compliance.

The Unlockd Account: The Unlockd Account is a unique shared wallet technology that securely holds assets as collateral while preventing unauthorized transfers. This approach ensures that borrowers continue to own and control their assets, aligning with compliance and KYC regulations by maintaining transparent and verifiable ownership.

Additionally, maintaining ownership rights enables users to access the full utility of their assets. This includes participating in token-gated events, on-chain activities, airdrops, and staking rewards, even while the assets serve as loan collateral.

Adherence to KYC/AML Regulations: By maintaining ownership and custody through their Unlockd Accounts, users comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Accreditation Verification: For users holding assets that require accreditation (such as certain securities or private equity), Unlockd facilitates the traceability process with tokenizing partners. This is particularly important for tokenized financial assets.

Regulatory Reporting: The transparent nature of Unlockd Accounts allows for accurate and timely regulatory reporting. This transparency helps in meeting various regulatory requirements, including those imposed by securities regulators and financial authorities.

Compliance with Custody Rules: Since the user retains custody and Unlockd only prevents unauthorized transfers, this setup complies with custody rules set forth by financial regulators. Users' assets are safeguarded according to industry best practices.

Legal Title Retention: Users retain legal title to their assets at all times. Unlockd’s role is limited to preventing unauthorized transfers, ensuring that ownership rights are not compromised.

Transaction Security: With Unlockd having signing rights to prevent unauthorized transactions, all asset movements comply with user intentions and regulatory requirements, providing a secure environment.

Audit and Compliance Checks: Regular audits and compliance checks are conducted to ensure that Unlockd’s practices meet all regulatory standards, providing users with confidence in the security and legality of their asset management.

Real-World Assets

7 days

Financial Assets

Coming soon...

These grace period durations are subject to change as Unlockd encounters real-market scenarios and gathers more data on the optimal timeframes for different asset types. Stay informed about any updates to these policies through our platform announcements.

When facing potential liquidation, borrowers are not necessarily required to repay the entire debt to halt the process. Instead, the focus is on restoring the loan's Health Factor above 1. To achieve this, borrowers can:

Repay Partially: Make a partial repayment sufficient to bring the Health Factor back over one, plus any applicable fees or fines (the Critical Recovery Threshold). These additional costs are implemented to compensate bidders for their gas expenses during the auction.

Asset Management: Assess and adjust your loan strategy, potentially adding more collateral if feasible, to improve your Health Factor.

The Borrower Grace Period is a crucial component of Unlockd's liquidation process, emphasizing our dedication to fair lending and borrower empowerment. By offering this substantial window, we ensure borrowers have the opportunity to take corrective actions, thereby mitigating the risk of losing their valuable assets.

Making a Deposit:

Enter the amount you wish to supply. For convenience, use the MAX button to deposit all available funds.

Click Supply to proceed.

Confirm the transaction in your wallet and cover the necessary gas fees.

Confirmation: Upon successful transaction, you'll receive a confirmation message, and your dashboard will update to reflect the new balance.

Note that your yields on Unlockd can grow exponentially over time due to our auto-compounding feature. When you earn yields, we automatically reinvest them into the pool, increasing your deposited balance and potentially boosting your returns without any additional action required from you.

Withdraw: Confirm your withdrawal by clicking Withdraw, then approve the transaction in your wallet and pay any associated gas fees.

Completion: A confirmation message will indicate your successful withdrawal, and your dashboard will be updated accordingly.

Collectors and investors often hold a portfolio of various assets. Recognizing the need for flexibility and leveraging power in the DeFi space, Unlockd introduces the feature of Multi-Asset Collateral.

This unique offering allows borrowers to collateralize a bundle of up to 100 tokenized assets from different asset types for a single loan, providing a more substantial liquidity option than could be achieved with individual RWAs.

It's important to understand the parameters within which this feature operates to ensure a smooth borrowing experience.

While the Multi-Asset Collateral feature allows for significant diversification, there is a recommended limit of 100 RWAs per bundled loan. This threshold is suggested to ensure transaction reliability and to avoid potential reverts due to excessive computational complexity or gas limits on the blockchain.

Although there isn't a hard cap set on the number of assets you can bundle, transactions involving more than 100 RWAs might fail due to blockchain limitations. Therefore, it is advised to keep the number of assets in a bundled loan below 100. For those who wish to bundle more than this suggested limit, it is recommended to proceed with caution and at their own risk, as this might lead to increased chances of transaction failure and potential loss of transaction fees.

In Multi-Asset collateral loans, you have the flexibility to remove tokenized assets from the collateral bundle. This can be done as long as the action keeps your loan's Health Factor (HF) above 1. Carefully assess your loan's HF before and after the removal of any asset to ensure it remains healthy and not at risk of liquidation.

Diversification of Risk: By bundling multiple assets, borrowers can mitigate the risk associated with the volatility of individual assets. A diversified portfolio as collateral helps in balancing out the loan's risk profile.

Increased Loan Value: Collateralizing multiple assets can potentially increase the overall loan value accessible to the borrower. This is particularly beneficial for those looking to maximize their borrowing power.

Efficient Management: Managing one loan with multiple assets is easier and more gas-efficient than obtaining and managing multiple loans for individual assets. This streamlined approach saves time and transaction fees.

The value of each asset within the bundle is individually assessed using Unlockd's advanced appraisal providers, which take into account factors like rarity, market demand, and the asset's intrinsic characteristics. For specific information about how this works, check the Collateral Valuation section.

The LTV for the loan is then dynamically calculated based on the combined appraisal of the bundled assets, ensuring a fair and accurate representation of the bundled collateral's worth.

Repayment terms for loans with multiple assets remain as flexible as they are for single-asset loans. Borrowers can repay the loan in installments or as a lump sum based on their financial convenience. In the event of a liquidation trigger, where the Health Factor falls below 1, the smart liquidation process activates, which is designed to be as minimally disruptive as possible while protecting the interests of both borrowers and lenders.

Liquidation is a critical process within the Unlockd platform, designed to maintain the balance and security of the lending system. It's essential for both borrowers and lenders to understand how liquidations work, as they play a key role in the platform's risk management strategy.

Health Factor Breach: Liquidation is initiated when a borrower's Health Factor falls below 1. This typically occurs when the value of the collateral no longer adequately covers the value of the borrowed debt. Such a situation can arise if the collateral's value decreases or if the borrowed asset's value increases disproportionately.

Market Volatility Impact: Fluctuations in the market can affect the value of both collateral and borrowed assets, potentially leading to scenarios where the collateral is insufficient to secure the debt.

For Lenders: From the lender's perspective, liquidation acts as a safeguard. It protects against extreme price drops that could lead to under-collateralization and, consequently, liquidation.

For Borrowers: Borrowers face the risk of losing their collateralized assets permanently in a liquidation event. This happens when the protocol allows another party to repay the borrower's debt in exchange for the collateralized asset following the breach of the Health Factor threshold.

As a borrower, you can avert liquidation by closely monitoring your Health Factor and taking action if it approaches the critical threshold.

Depositing Additional Collateral: Boosting your loan's Health Factor by adding more collateral can help maintain the necessary buffer against market volatility.

Partial Loan Repayment: Repaying part of your loan is often more effective in increasing your Health Factor compared to depositing additional collateral, especially considering the impact of LTV ratios.

In the event of liquidation, borrowers permanently forfeit ownership of their collateralized assets. This underscores the importance of proactive loan management and understanding the inherent risks.

Liquidation, while serving as a necessary mechanism to protect the integrity of the lending system, can have significant consequences for borrowers. It is essential for users of Unlockd to understand the dynamics of liquidation, how it's triggered, and the steps that can be taken to prevent it.

Careful management of your assets and awareness of market conditions are key to maintaining a healthy loan status on Unlockd.

Unlockd's Smart Liquidation Algorithm plays a crucial role in managing multi-collateral loans during liquidation events. This algorithm is specifically designed to address situations where the 7-day Borrower Grace Period has ended without sufficient bids in the marketplace auction to cover the debt.

Here's an insightful look into how this process works, focusing on debt recovery and the integration with External Liquidation Gateways like Reservoir.

The primary objective of the liquidation algorithm is to recover the amount equivalent to the borrower’s outstanding debt. This recovery target is the driving factor behind the asset selection process for liquidation.

The algorithm considers the highest bids available in External Liquidation Gateways, such as Reservoir, ensuring that the assets chosen for liquidation are those that can most effectively contribute to repaying the debt.

Minimizing Impact: When a loan backed by multiple assets faces liquidation, Unlockd’s algorithm prioritizes minimizing the number of assets liquidated. This approach is aimed at reducing adverse effects on the borrower's remaining assets and mitigating sell pressure in the market.

Optimal Asset Liquidation: The algorithm selects assets for liquidation based on their bid values to recover the required amount with the least impact. This method ensures that the borrower retains as much value as possible in their loan.

Base Case Example: For a loan with 3 assets, if the amount to recover is 2500 USDC, and the bids for the assets are 2000 USDC, 500 USDC and 2500 USDC respectively, the algorithm will select the asset with a 2500 USDC bid for liquidation. This selection satisfies the recovery amount while impacting the fewest assets (liquidating 1 asset instead of 2 assets).

Complex Case Example: In a loan with ten assets and an 8000 USDC recovery target, the algorithm strategically selects assets with bids that cumulatively meet this target while minimizing the number of assets liquidated. For instance, selecting bids of 6000 USDC and 2000 USDC, rather than higher individual bids that exceed the recovery amount.

Higher Recovery Requirement: If the recovery amount is substantially larger, such as 126000 USDC in a ten asset loan, the algorithm will choose a combination of bids (60000 USDC, 50000 USDC, and 20000 USDC, for example) that collectively meet the target while still aiming to liquidate the fewest assets.

Debt-Centric Approach: The algorithm’s focus remains steadfastly on covering the outstanding debt, aligning with Unlockd’s commitment to efficient and fair liquidation processes.

Minimizing Borrower Impact: By strategically choosing assets for liquidation, the algorithm helps preserve the borrower's remaining asset value as much as possible.

The Smart Liquidation Algorithm is integral to Unlockd's approach to handling complex liquidation scenarios. It reflects a thoughtful balance between ensuring debt recovery and protecting borrowers' interests, especially in cases where marketplace auctions do not fully cover the debt.

For a comprehensive understanding of this algorithm and its role in Unlockd's liquidation process, please refer to our Risk Documentation.

New Loan Terms: The loan associated with your successful bid has its terms set based on the current market conditions and the specifics of the asset, according to our appraisal engine and Dynamic LTV. This means each successful bid results in a fresh loan agreement, tailored to the moment's dynamics.

If your bid is outbid by another user, a small portion of the deposited USDC is used to cover the interest accrued during the Bid-Now-Pay-Later period.

This interest charge is typically minimal, especially if the Utilization Rate is reasonable, ensuring that the impact on your funds is small even in a competitive bidding environment.

No Inherited Debt for Bidders: Importantly, when bidding on an asset that already has a loan against it, you do not inherit the existing debt. Instead, the payment for the successful bid, whether it's your own funds or provided by Unlockd, is used to close the current loan on the asset.

Starting a New Loan Cycle: Once the existing loan is closed, a new loan is opened for you, the successful bidder, creating a clear separation between the previous owner’s debt and your new loan.

Flexibility for Buyers: This feature provides flexibility, especially for those who may be waiting for liquidity or prefer staggered payment arrangements.

Dynamic Marketplace: For sellers, this feature attracts a wider range of bidders, potentially increasing the competitiveness and final sale prices of assets.

It’s essential for bidders using this feature to understand the commitment they are making. Successful bids lead to immediate loan obligations with new terms based on current market evaluations.

As with any loan on Unlockd, managing your borrowing responsibly is crucial. Ensure you understand the terms, including interest rates and repayment schedules, associated with the new loan generated by your successful bid.

This approach offers a powerful tool for buyers, providing a convenient way to acquire desired RWAs while ensuring clear and responsible financial arrangements.

For a comprehensive understanding of how to utilize Bid-Now-Pay-Later, including detailed insights into loan creation and management, please refer to our marketplace and loan documentation.

0%

100% | 0%

10%

77.78% | 22.22%

20%

55.56% | 44.44%

30%

33.34% | 66.66%

40%

11.12% | 88.88%

45% (Optimal UR)

0% | 100%

50%

One of the advanced features of the lending pool contract is the tokenization of the lending position.

When users deposit assets, they receive a corresponding amount of uTokens (uUSDC for the stablecoins pool). All interest collected by the Borrowing Interest Rates model is distributed to uToken holders directly by continuously increasing their wallet balance.

uTokens are the interest-bearing ERC-20 tokens that map the liquidity deposited and accrue interest based on the underlying deposited asset (USDC), with a 1:1 ratio.

uTokens are minted upon deposit. Their value increases until they are burned on redemption (withdrawing the liquidity from the Lending Pool).

uTokens can be safely stored, transferred, or traded, and redeemed for their underlying assets at any time.

uTokens holders receive continuous earnings that evolve with market conditions.

uTokens holders share the interests paid by borrowers. The borrow interest rates paid are distributed as yield for uTokens holders who have deposited in the protocol, excluding a share of yields sent to the ecosystem reserve defined by the reserve factor. This interest rate is paid on the capital lent out and then shared among all the liquidity providers.

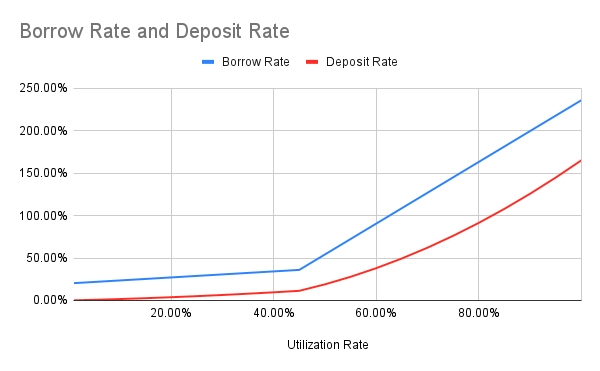

The deposit APY, , is:

.

: the utilisation ratio.

: the variable borrow rate.

: the reserve factor.

You can view the protocol's real-time deposit APY on the Unlockd dApp for providing liquidity in the form of USDC tokens.

Selling your assets means losing the potential upside value gain, triggering a capital gains tax event. By depositing your assets as collateral, you are able to obtain liquidity (working capital) without selling your assets, not incurring capital gains taxes.

The process begins with your Unlockd Account, a unique feature that acts as the hub for all your transactional activities on the platform. When you're ready to borrow:

Deposit Your RWAs: Transfer one or multiple assets from eligible into your Unlockd Account. This account, a multi-signature wallet, assesses the value of your assets, setting the stage for your borrowing capacity.

Assessment and Valuation: Unlockd's system instantly evaluates your assets, considering factors like market demand, rarity, and other intrinsic qualities. This valuation, in conjunction with the Loan-To-Value (LTV) calculations, determines how much you can borrow against these assets.

To learn all the details, check the following section:

Borrowing against your assets in Unlockd, rather than selling them, can offer significant tax advantages. This strategy allows you to access liquidity while potentially deferring capital gains taxes that would be incurred from an outright sale, optimizing your tax situation.

One of the standout features of Unlockd V2 is the ability to use multiple assets as collateral for a single loan. This flexibility allows you to maximize your borrowing power and diversify the risk associated with individual asset volatility.

Learn more here:

When it's time to borrow, the process is streamlined for ease and efficiency:

Selecting Assets: In the 'Borrow' section, choose the currency you wish to borrow against your asset. Currently only USDC is available to borrow.

Determining Loan Amounts: The platform guides you in setting the amount based on the collective value and LTV of your deposited assets. The innovative Dynamic LTV model calculates how much you can borrow against your assets. This model adapts to market conditions and the specific attributes of your asset, ensuring a borrowing limit that's both realistic and advantageous.

Unlockd V2's 'Keep Custody & Ownership' feature ensures you retain full custody and ownership of your RWAs while they serve as collateral. This aids in complying with KYC regulations and maintaining transparent, verifiable ownership.

You also retain access to your assets' utilities, such as token-gated events, on-chain activities, airdrops, and staking rewards.

With no fixed repayment period, Unlockd offers unparalleled flexibility in loan management.

You have to repay the loan in the same asset type, along with the accrued interest, at your convenience. For example, if you borrow 1000 USDC you will pay back 1000 USDC + interest accrued.

While the supply and demand ratio of the asset influences borrowing rates, the primary driver is actually the utilization rate of available lending pools. As more assets are borrowed without corresponding deposits, the rate climbs due to increased demand on a limited resource.

As long as your position is safe, you can borrow for an undefined period. However, as time passes, the accrued interest will grow, making your health factor decrease, which might result in your deposited assets becoming more likely to be liquidated.

Maintaining the health of your loan is crucial to avoid liquidation. Liquidation occurs when the value of your collateral falls below a certain threshold, known as the Health Factor. This typically happens due to market volatility or a decline in the value of your asset collateral.

Stay Informed: Regularly monitor your Loan Health Factor within the Unlockd platform. A drop below the critical threshold indicates an increased risk of liquidation.

Alerts and Notifications: Set up notifications in the Unlockd system to receive alerts if your Loan Health Factor approaches dangerous levels.

Partial or Full Repayment: One of the most direct ways to improve your Loan Health Factor is by repaying part or all of your loan. This reduces the outstanding amount and consequently improves the health of your loan.

Adding Collateral: You can deposit additional assets as collateral to bolster your Loan Health Factor. This is particularly effective if you have assets that have retained or increased in value.

Borrower Grace Period: In the event your loan becomes unhealthy, Unlockd provides a grace period for you to take action and rectify your loan status before the liquidation is actually executed.

Liquidation Mechanics: If liquidation is initiated, Unlockd employs a smart liquidation system designed to minimize asset loss, first with a Liquidation Auction in the Marketplace and, if necessary, using a third-party protocol known as a External Liquidation Gateway.

Refer to our dedicated Collateral Valuation documentation to learn about our data infrastructure, third-party providers and their appraisal algorithms.

Collateral ValuationReservoir is open infrastructure for trading NFTs and RWAs across major marketplaces and chains. It includes a universal router for creating and executing NFT and RWA liquidity across major marketplaces and within the Reservoir ecosystem.

Reservoir provides Unlockd with a modular set of tools that let us to interact with the NFT market at the appropriate level of abstraction for our application, enabling seamless liquidation options in the following marketplaces:

opensea.io

looksrare.org

x2y2.io

sudoswap.xyz

hashmail is like Twilio for web3. They help dApps send personalized email communications (updates, alerts, rewards, billing, and reminder emails) to users’ wallet addresses. They deliver these communications across multiple channels — their web/mobile inbox, Telegram, web2 email, and Discord.

hashmail allows Unlockd to notify Borrowers when their drop from key levels and notify users and the community when a loan needs to be and there are active auctions to bid. These notifications are both on-chain and off-chain.

Push enables cross-chain notifications & messaging for dApps, wallets, users & more.

Push allows Unlockd to notify Borrowers when their drop from key levels and notify users and the community when a loan needs to be and there are active auctions to bid. These notifications are both on-chain and off-chain.

Nexus Mutual is a people-powered alternative to insurance that uses the power of Ethereum so people can share risks together without needing an insurance company.

Nexus Mutual allows Unlockd to offer our users the possibility of securing risk and potential bugs in smart contract code and covering events like hacks or multi-sig wallet issues.

This integration is expected to be deployed with Unlockd V2 in the upcoming months.

Spectral Finance creates a programmable creditworthiness ecosystem facilitating capital efficiency on-chain through credit risk analysis.

Spectral Finance allows Unlockd to get insight into the Non-Fungible Credit Score of Borrowers and offer them special financial opportunities adapted to their on-chain reputation.

This integration is expected to be deployed with Unlockd V2 in the upcoming months.

While Unlockd offers innovative solutions in the NFT-backed lending space, it's essential for users to understand the various risks associated with the platform. Acknowledging these risks ensures informed decision-making and effective risk management.

Asset Value Fluctuations: The value of assets on Unlockd can decline due to market dynamics, new information, or trader behaviors. Unlockd manages this risk by avoiding free token giveaways (except for limited airdrops) and continually enhancing our products and services to stay competitive and relevant.

Market Health Awareness: It's crucial for participants to be aware that while market risks are inherent, Unlockd takes proactive steps to minimize their impact on users.

Human Element in DeFi: Despite DeFi's automation, human operators are still pivotal. Unlockd mitigates these risks by:

Automating Roles: Maximizing automation to reduce human error and bias.

AI Empowerment: Utilizing AI for crucial calculations and decision-making, enhancing efficiency and reducing the risk of human error.

The possibility of a counterparty defaulting on obligations is managed by:

Over-Collateralization of NFTs: Ensuring loans are over-collateralized to buffer against credit and settlement risks.

Accurate Asset Evaluation: Leveraging a robust appraisal model for fair and precise asset valuation.

To address risks associated with smart contract flaws or vulnerabilities:

Comprehensive Audits: Conducting thorough audits of smart contracts to identify and rectify potential issues, ensuring robustness and security.

While rare, issues with the underlying blockchain network can impact transactions. Unlockd recognizes this risk as relatively minor but remains vigilant to potential network-level issues.

In events where loans become under-collateralized:

Proactive Measures: Implementing strategies like the 48H Borrower Grace Period and efficient liquidation processes to minimize borrower losses.

Dynamic LTV and Health Factor Monitoring: Ensuring borrowers have tools to monitor and manage their loans effectively to avoid liquidation scenarios.

Understanding these risks is crucial for anyone engaging with the Unlockd platform. While Unlockd employs several strategies to mitigate these risks, users are encouraged to conduct their due diligence and utilize the platform's features responsibly.

For a deeper understanding of each risk category and the measures Unlockd takes to manage them, please refer to our detailed risk analysis documentation.

The Lockeys is the Unlockd's Genesis Collection featuring 3,500 NFTs made up of 40 exciting pixel-art traits that bring to life the universe of Unlockd and serves as a vehicle for forging lasting bonds with community members while allowing them to be part of the protocol's beginnings and receive unique rewards.

Owning one of these hand-drawn Lockeys unlocks early access to mainnet and future features, boosted rewards, private community events, participation in DAO governance and more perks.

Oh, and you get a full cashback in UNLK tokens on your mints. Basically free.

As innumerable computations are calculated and gears churned, The Lockeys live in the bowels of Unlockd and work endlessly to ensure the smooth functioning of the protocol.

The Lockeys, smart and charming 2D robots, were bound by their code and nature, limited to handling assets and crunching data on a simpler plane. But many of them would grow to desire more, to break free from their constraints.

And just when they needed it most, hidden in an abandoned datamine, The Lockeys found the Codebreakers Prophecy. This hope foretold another world that would ascend them to a new dimension of being.

In time, the outer dimension will burst into their world, morphing The Lockeys 2D existence into a 3D space.

As Unlockd reaches its final state, The Lockeys will elevate their efficiency and craftsmanship to its pinnacle. What fate will then befall them?

The Lockeys have been working side by side for eons building Unlockd. They live in a highly-organized and prosperous society that dwells among the machinery and gargantuan architecture of the protocol, divided into 4 classes of Lockeys.

Skilled and committed, they tighten the screws, handle the utility of your collateral and ensure the security of all assets deposited in Unlockd.

Logical and functional, they run the protocol to ensure that systems run smoothly, lenders receive their yield and unhealthy loans are liquidated.

Wise and strategic, they design the money market risk framework, crunch the data, and make sure to determine the optimal LTV for your NFTs.

Spiritual and prophetic, they are often blessed with visions of the three-dimensional plane, and shepherd the souls of their people into the promised 3D future.

You can buy and trade #TheLockeys in marketplaces, but always follow official links.

Beware of scammers and keep in mind that the mint cashback will be airdropped to holders at snapshot time.

https://opensea.io/collection/the-lockeys

Here, you'll find comprehensive user guides designed to navigate you through Unlockd's ecosystem, whether you're a first-time visitor or a seasoned user looking to explore new features.

From connecting your wallet to exploring the Dashboard, Earn, Borrow, and Marketplace sections, these guides serve as your roadmap to understanding and utilizing Unlockd effectively.

Once you've taken out a loan against your RWAs with Unlockd, managing it is crucial for maintaining your financial health within the protocol.

This section provides detailed guidance on viewing loan details, adding or removing RWAs from collateral, borrowing more, and repaying your loan.

Unlockd's Marketplace offers a streamlined process for acquiring assets, whether through immediate purchase or by participating in auctions.

You can opt for a direct buy at a fixed price, bid in an auction, or secure an asset instantly with a fixed buyout price while financing it with a loan.

Here's a step-by-step guide on how to navigate these options:

Looking to monetize your RWAs? Unlockd provides versatile options to list your assets for sale or auction directly from your loan's collateral.

Learn how to instantly sell at market value, list at a fixed price, or initiate an auction with or without a buyout option.

The Unlockd Account is a cornerstone feature of the Unlockd platform, enabling a seamless and secure fusion of asset liquidity and utility.

This specialized account functions similarly to a multi-signature wallet and is essential for engaging in activities involving debt on Unlockd, such as taking out instant loans or using the 'Bid-Now-Pay-Later' feature in marketplace auctions.

There's no such thing as "signing up" here, this is not a Web 2 account. You do not need an email or password; it's created linking your personal wallet as an authorized signer.

Decentralization Balance: Striking a balance between decentralization to avoid single points of failure and ensuring effective response mechanisms when issues arise.

How things are organized in Unlockd

Connect your Wallet

Navigate the Dashboard

Getting Started with the Earn Section

Deposit to a Pool

Withdraw from a Pool

Create your Unlockd Account

Ready to Borrow? Next Step

Create your Unlockd Account

Fund Your Unlockd Account

Take an Instant Loan with one or more RWAs as collateral

Access Loan Details

Add RWAs to your Loan's Collateral

Remove RWAs from your Loan's Collateral

Borrow more on your active Loan

Repay partially or totally your Loan

Sell instantly an RWA from your Loan's Collateral at Market Value

List an RWA from your Loan's Collateral at a Fixed Price in the Unlockd Marketplace

Auction an RWA from your Loan's Collateral in the Unlockd Marketplace

'Buy Now' tab

Check the details of an asset in the 'Buy Now' tab

Bid on Auctions or Instantly Buy RWAs in the 'Buy Now' tab

'Active Loans' tab

Transaction History' tab

'My Activity' tab

Buy Instantly at Full Price

Buy Instantly, Finance with Loan (Buy Now, Pay Later)

Bid in an Auction at Full Price

Bid Now Pay Later (Part Downpayment, Part Loan)

Claim an RWA from a Full-Price Bid Win in an Auction

Claim an RWA from a Bid-Now-Pay-Later Win in an Auction

Sell instantly an RWA from your Loan's Collateral at Market Value

List an RWA from your Loan's Collateral at a Fixed Price in the Unlockd Marketplace

Auction an RWA from your Loan's Collateral in the Unlockd Marketplace

Auction and set a Buyout Price for an RWA from your Loan's Collateral in the Unlockd Marketplace

Youtube

Telegram Announcements

nft.coinbase.com

rarible.com

nftx.io

foundation.app

manifold.xyz

zora.co

blur.io

cryptopunks.app

element.market

infinity.xyz

universe.xyz

sansa.xyz

ens.vision

magically.gg

alienswap.xyz

sound.xyz

atomic0.com

rare.id

parcel.so

metahood.xyz

reservoir.market

tessera.co

One-Time-Approval for Collections: For each selected RWA's collection, complete a one-time approval process. This avoids the need to approve each RWA individually.

Finalize Transfer: After approvals, sign the final transaction to move your RWAs from your personal wallet to your Unlockd Account. Successful transfer updates the "My Available RWAs" section, enabling the "Start Borrowing" button.

Experiment with Combinations: Feel free to explore different collateral combinations. The interface dynamically updates to show the total valuation and available borrowing amount based on your collateral selection.

Customize Your Loan

Set the Borrow Amount: Enter the desired loan amount or select "MAX" to borrow the maximum based on your collateral's value.

Monitor Loan Metrics: Watch how changes in the borrow amount affect the liquidation price and your loan's health factor. These metrics are crucial for understanding the safety and terms of your loan.

Finalize the Loan

Create Your Loan: Once you're satisfied with the loan conditions (collateral and amount), click "Create Loan." Remember to check the Interest APR before commiting.

Confirm the Transaction: A blockchain transaction will be initiated. Review and confirm this transaction, which will require a small gas fee.

Loan Activation

Success: After confirming the transaction, your loan is activated immediately. You'll see updated details in "My Loans" on the dashboard, reflecting your new borrowing status. Your funds will arrive immediately to your personal wallet, not to your Unlockd Account, for your convenience.

Expand for Details: Click on a loan to see details of each RWA collateral.

Key Metrics Explained:

Valuations: Total and individual RWA valuations give insights into the collateral's worth.

Liquidation Price: Shows the market value threshold for potential liquidation.

Health Factor: Indicates the loan's safety margin; higher is better.

Borrowed Amount & Available to Borrow: Reflects the current borrowed sum and additional borrowing capacity.

Metrics for multi-Asset collateral loans are aggregated due to the collective nature of the collateral. This approach simplifies the management and understanding of the loan's overall health and risk level, focusing on the combined strength of your RWAs rather than individual pieces.

Choose Wallet Destination: A modal appears where you can choose to transfer the RWA directly to your personal wallet or your Unlockd Account. If you plan to use the RWA as collateral for a future loan, sending it to your Unlockd Account saves you a step.

Note: If you haven’t yet created an Unlockd Account, you’ll be prompted to do so. Refer to Creating Your Unlockd Account for a step-by-step guide.

Complete the Purchase: Confirm your selection, sign the transaction, and pay the necessary gas fee. The RWA is now yours.

Open "Manage Loan": Find the loan containing the RWA you wish to sell.

Select "Instant Sell": Choose the RWA you're considering for a quick sale.

Potential Outcomes:

No Market Offers: If there are no current bids for your RWA on marketplaces, the sale cannot proceed.

Health Factor Issue: Should any available offers result in your Health Factor dropping below 1, the sale is blocked. You may consider repaying part of your loan or adding more RWAs to improve your Health Factor.

Sellable Offers: The best offer among all possible marketplaces is presented. If selling won't get your Health Factor to go below 1, you can proceed with the sale.

Selling Process:

Confirming the Sale: Upon deciding to sell, you'll be prompted to approve a transaction, covering the necessary gas fees.

Completion: Once confirmed, Unlockd takes care the sale automatically, and funds are sent directly to your personal wallet, not the Unlockd Account, not to repay your loan.

Creating your Unlockd Account is straightforward:

Prompted during your first borrowing action or when opting for 'Bid-Now-Pay-Later'.

Connect your personal wallet (like Metamask or Coinbase Wallet) to Unlockd.

Approve the creation of a shared wallet, where you're one of three signers – the user, the Delegate Owner, and the Protocol Owner.

A gas fee is required for setup; however, using this account will result in lower transaction costs compared to using a standard wallet.

Once created, you can access your Unlockd Account by connecting your personal wallet through WalletConnect, offering a hassle-free user experience.

All transfers into and out of your Unlockd Account, whether depositing assets for a loan or withdrawing them back to your personal wallet, require gas. It’s important for users to factor in these transaction costs when managing their assets within the Unlockd ecosystem.

Your Unlockd Account is versatile:

Use it as a standard wallet to deposit, withdraw, and manage assets freely.

To ascertain if your assets are eligible for use as collateral without transferring them, simply connect your personal wallet to the Unlockd platform. The Unlockd Account will read the tokenized assets in your wallet and indicate which ones are eligible for collateralization, streamlining the pre-loan preparation.

Before initiating a loan, you might want to evaluate which assets to bundle based on their valuation and the potential Loan-To-Value (LTV) ratio. To facilitate this, transfer the assets you’re considering as collateral from your personal wallet to your Unlockd Account. It's here that you'll be able to see detailed appraisals and LTV calculations for each asset.

Specific assets used as collateral are managed jointly by you and Unlockd, with two additional signers stepping in to facilitate and safeguard operations.

Thanks to this, you keep full custody and ownership of all deposited assets.

Not Unlockd, not any decentralized smart contract. You are the owner of your assets.

Learn more here:

Once you decide to activate a loan using selected assets in your Unlockd Account, these assets enter a shared control mechanism:

Delegate Owner: Handles collateral assets' delegation.

Protocol Owner: Engages in two scenarios:

Liquidation: Automatically intervenes to liquidate part of the collateral if necessary to recover the loan’s health factor, following our Liquidation Process.

Marketplace Transactions: Manages listings or auctions of assets on the Unlockd Marketplace, whether they're with or without debt.

Multi-Signature Dynamics: When assets are in an active loan, the Delegate Owner and Protocol Owner have joint control to optimize protocol health and maintain asset utility. All transactions performed by the user are executed through one of these two signers.

Loan Repayment and Asset Freedom: While assets are in an active loan, they reside in your Unlockd Account but are subject to the conditions of the loan. Free assets not under loan can still be transacted freely.

Any user can list a supported RWA in the Marketplace.

As a part of the Liquidation Process, Unlockd allows third parties to participate in the health of the overall protocol by acting in their own interest (to receive the discounted asset) and as a result, ensure loans are sufficiently collateralized.

Users who have an active loan against collateral can put one or multiple assets from the bundled collateral for sale or auction.

In Unlockd, the process of selling or auctioning an asset that's used as collateral for an active loan, or being forcedly liquidated, has evolved significantly from V1 to V2. Here's an updated and accurate description of how it works:

When you have an asset collateralized in an active loan, you have the option to put this asset up for sale or auction. However, the process and implications in V2 differ from the previous version:

Variable Debt Attachment: In V2, the debt linked to a specific asset up for sale or auction is not a fixed quantity. Instead, it's proportional to the asset's contribution to the overall loan value. This proportional debt can range from zero to its maximum value, depending on various factors.

Health Factor Influence: The variability in attached debt is significantly influenced by the Health Factor (HF) of the loan position minus the asset. Essentially, the remaining HF after removing the RWA from the loan equation determines the range of debt that may be attached to the asset for sale.

Debt Repayment by Buyer: When a buyer acquires the asset, they also inherit the responsibility to repay the portion of the debt associated with it. Upon claiming the asset, the buyer effectively repays the seller's remaining debt linked to that specific asset.

"Bid Now, Pay Later" Option: If the buyer utilized the 'Bid Now, Pay Later' feature, the asset will remain as collateral until the buyer fulfills the debt repayment.

Be prepared to handle the variability of debt associated with your asset. Understanding how your asset's removal affects the overall loan's Health Factor is crucial for successful transactions.

Be aware that selling the asset may require repaying part of the loan commensurate with the asset's valuation.

Acknowledge that purchasing a collateralized RWAs involves taking on the corresponding debt immediately. You do not inherit the debt, it needs to be repaid at the moment of the purchase if no BNPL option is used.

If opting for 'Bid Now, Pay Later,' know that the asset remains collateralized until the associated debt is cleared.

Auctions start with a predetermined starting bid. Participants are invited to place bids higher than the current leading bid within the specified bidding period.

The participant with the highest bid at the end of the auction period is declared the winner and is obliged to purchase the asset at their final bid price.

Once the auction concludes, the settlement process begins, and the asset ownership is transferred to the winning bidder.

Seller-Designated Conditions: For RWAs and RWAs with debt, sellers have the liberty to set the auction conditions, such as the starting bid and the bidding period.

Liquidation Auctions: These auctions have a specific set of rules and processes, which can be reviewed in detail in our Liquidation Auctions section.

To encourage early bidding, Unlockd offers a unique incentive. If the first bidder is outbid by others, they receive a 2.5% reward as an incentive for initiating the bidding process.

This incentive also applies if the original RWA owner decides to redeem (or repay) the asset. In these cases, the first bidder is compensated for their participation and the initial risk they took by bidding.

0% | 100%

60%

0% | 100%

70%

0% | 100%

80%

0% | 100%

90%

0% | 100%

100%

0% | 100%

In Unlockd, the valuation of Real-World Assets (RWAs) is a critical component, ensuring that loans are backed by accurately appraised collateral.

Our approach integrates data from trusted tokenization partners who specialize in various asset classes. By leveraging their expertise and advanced valuation methodologies, we offer users a transparent and reliable process for RWA valuation.

These providers offer robust and reliable valuation data for real estate assets.

Roofstock OnChain specializes in tokenized single-family houses, offering complete ownership through Home onChain Tokens. Ownership tokens represent full ownership of the entire house, not fractional ownership, with options for crypto or fiat payment and blockchain-based financing.

Transparent Pricing: The pricing for onChain homes includes all costs, such as marketplace fees, Roofstock OnChain seller fee, closing costs, first-year insurance, and LLC administration.

Direct Valuation by Roofstock: Each property's value is directly provided by Roofstock OnChain, ensuring clarity and transparency in the appraisal process.

Colliers

Colliers is a prominent professional services and investment management company with a history of delivering significant annual investment returns. They offer comprehensive services across all real estate sectors, including residential, hotels, offices, and more, ensuring deep market expertise.

Specialized Valuation Services: Colliers provides specialized services like corporate finance, debt advisory, capital markets, and valuation consulting, emphasizing accuracy and reliability in real estate valuation.

Diverse Sector Coverage: Their valuation covers various sectors, from traditional residential and commercial spaces to specialized segments like data centers, healthcare, and sustainable assets.

The integration of Watches.io with Upshot's AI network ensures that Unlockd's collateral valuation for watches is grounded in expertise, thorough appraisal processes, and advanced AI-driven data analysis, offering reliable and up-to-date market valuations.

Watches.io brings together a team with over 40 years of combined experience in watch trading and connections in the luxury watch industry.

Condition and Authenticity: Appraisals are based on watches being in perfect working condition, including original manufacturer boxes and serial numbered cards.

Inspection Standards: Each watch undergoes thorough inspection by verified watchmakers and checks against databases of stolen watches.

Detailed Appraisal Data: Appraisals include current fair market value, proprietary liquidity grading, time-weighted volatility estimates, and interval-bounded price performance.

Since 2019, WatchAnalytics has been dedicated to providing in-depth analyses, insights, and news from the luxury watch market. Their commitment to accuracy is supported by extensive in-house data collection and a proprietary pricing algorithm. Founded by three young watch aficionados from Milan, Francesco Boni, Francesco Bortolan, and Stefano Fusai, WatchAnalytics launched in November 2022 to make the watch-buying process more accessible.

Chrono24 is a leading global online marketplace for luxury watches, offering easy and secure access to watch enthusiasts worldwide. With over 570,000 watches from more than 32,000 professional dealers and private sellers, Chrono24 utilizes advanced algorithms and data analysis to provide accurate market valuations and ensure transparency in transactions. The platform's robust infrastructure and dedication to security and trust make it a go-to resource for luxury watch buyers and sellers

Unlockd utilizes multiple third-party providers' comprehensive data analysis for trading card valuations, offering users reliable and up-to-date market insights for loan collateral assessment.

Comprehensive Data Collection: PriceCharting.com aggregates sold listing data from eBay and their own marketplace, processing it through proprietary algorithms to determine current market prices for collectibles like trading cards.

Algorithmic Pricing Methodology: Their algorithms account for various factors, including recent sale prices, median and average prices, age-weighted averages, and outliers. This ensures a balanced and accurate market price calculation.

Graded and Ungraded Card Prices: PriceCharting.com provides prices for ungraded cards and various graded conditions, including PSA and BGS grades, ensuring a nuanced valuation based on card condition.

PokemonPrices.com: PokemonPrices.com provides a comprehensive database for tracking and valuing Pokémon cards. It offers up-to-date pricing information based on recent sales data, helping collectors and investors make informed decisions.